THERE IS A NEW RISK IN TOWN!

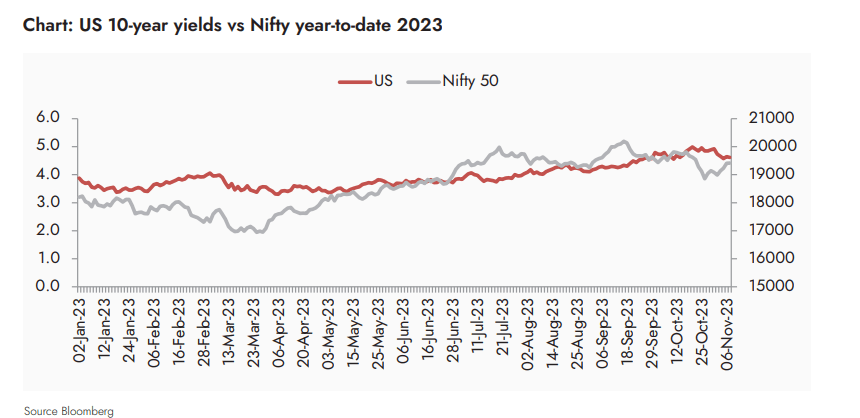

Rising US bond yields have become a cause for worry for the markets. This year, after consolidating from January to April, yields have been rising. The US 10-year yield made its 2023 low of ~3.25% in April – the markets initially took the rising yield in its stride. Once the yield crossed the 2022 high of 4.25% in September, fear set in. Over April-July, Nifty rose 13.8% and over August-October lost 3.4%. In the last two months (September and October) FIIs pulled out Rs40,000cr from Indian equities. 5% bond yield is now considered to be the line in the sand perhaps because it is too uncomfortably close to the pre-GFC peak of 5.25%, seen in 2007!

As we go into print, yields have pulled back from danger zone on weak US non-farm payroll print of 150,000 on 3 November. In a heads-I-win, tails-you-lose market – the focus is not on the fears of a weaker economy, but the joys of declining yields in the US and the rising probability of rate cuts. The markets are now building in a June 2024 rate cut by the Federal Reserve. Whether that happens or not will be tested a few months later, and until then we are back to the Goldilocks world. Not too hot and not too cold.

Are we close to a cycle top?

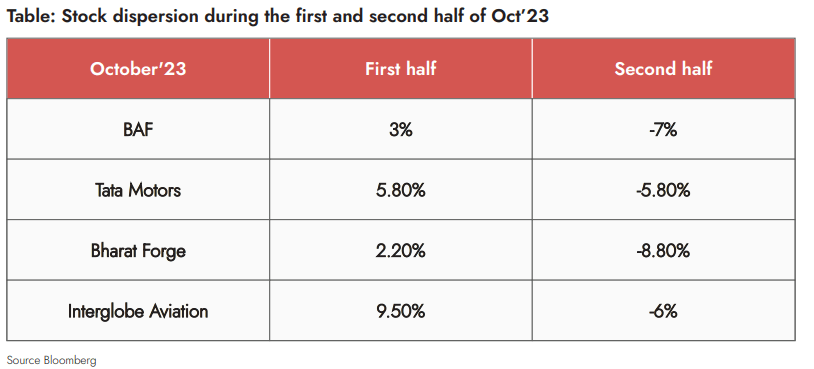

Nifty lost 2.8% in Oct, 2.4% since the inception of Ambit 365 (Oct 6) – but, it is the tale of 2 halves. Nifty was up ~1% till mid-month, only to sell off sharply in the second half of the month. Many top performers (in our portfolio) of the first half of the month become bottom performers during the second half of the month, neutralizing all our gains. While the short book made money this month, the sharp reversal in the long book took all the gains away. We closed the month slightly positive.

OUTLOOK

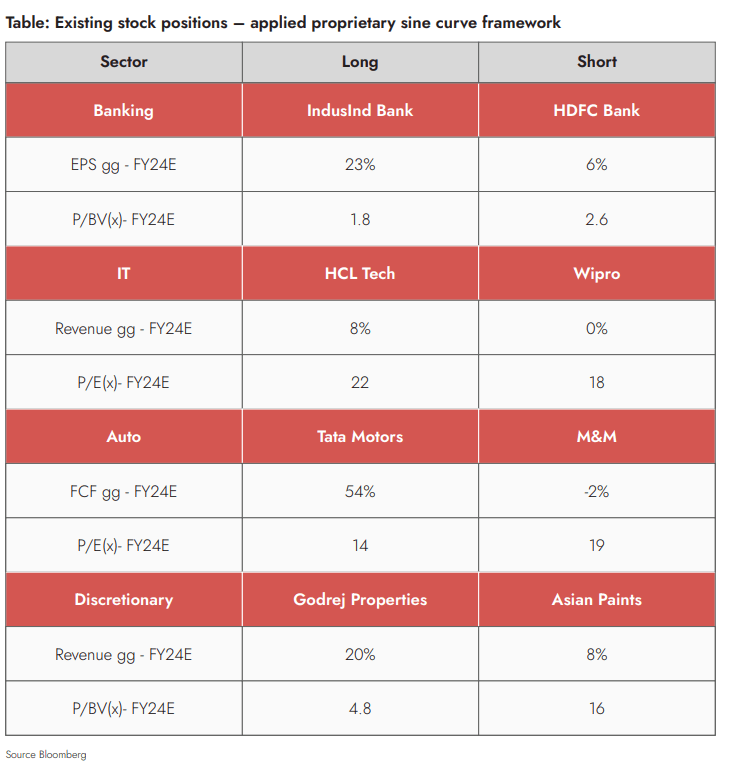

As we speak, it is yet unclear whether the pullback in the US yield is just a ‘trade’ or it has reversed for good and, consequently, Nifty’s rally is just corrective or a new move has started. Also unclear is when the USA’s economic weakness will start to pinch the markets. Sentiment can very quickly move from all news being good news to all news being a source of worry! One thing is for sure. We have entered a period of high volatility now, and the going from here won’t be as smooth as it has been in recent months. Equity market volatility is always preceded by bond and currency market volatility, and we are seeing that play out. The nervous breakdown markets seemed to have with US yields touching 5% and the joyous rally on a pullback bear testimony to this trend. Reflecting this view, we have started the month a little cautiously. And, as we see more signs of confirmation, we will build our book. Also, we have noticed that markets are focused on growth-adjusted valuations – we hear PEG (PE / Growth ratio) being talked of a lot more often now, more than ever in the last 5-8 years! Our current stock book takes this trend into cognizance.

CONCLUSION

We see risks rising. Markets will have to choose between the lesser of the two evils – a lower bond yield or a weakening economy. India sentiment continues to be robust, and domestic flows into equities are yet strong, and have the capability to offset the global headwinds. In environments like these, stock performances can display high degrees of dispersion. While this is an opportunity for Ambit 365, we need to exercise extreme rigour in stock selection.

For other queries, please contact:

Rahul Maheshwary – Phone: +919920139053 , Email – rahul.maheshwary@ambit.co

Registered Address: Ambit Investment Managers Private Limited

Ambit House, 449 Senapati Bapat Marg, Lower Parel, Mumbai – 400 013

Corporate Address: Ambit Investment Managers Private Limited

2103/2104, 21st Floor, One Lodha Place, Senapati Bapat Marg, Lower Parel, Mumbai – 400 013

RISK DISCLOSURE & DISCLAIMER

“AMBIT 365” is a scheme of “Ambit Investment Managers Trust” registered with SEBI as a Category-III Alternative Investment Fund. Ambit Investment Managers Private Limited (Ambit) is the Investment Manager to the scheme. The purpose of this presentation is to provide general information of a product structure to prospective investors in a manner to assist them in understanding the product. This presentation / newsletter / report is strictly for information and illustrative purposes only and should not be considered to be an offer, or solicitation of an offer, to buy or sell any securities. This presentation / newsletter / report is prepared by Ambit strictly for the specified audience and is not intended for distribution to public and is not to be disseminated or circulated to any other party outside of the intended purpose. This presentation / newsletter / report may contain confidential or proprietary information and no part of this presentation / newsletter report may be reproduced in any form without its prior written consent to Ambit. All opinions, figures, charts/graphs, estimates and data included in this presentation / newsletter / report is subject to change without notice. This document is not for public distribution and if you receive a copy of this presentation newsletter / report and you are not the intended recipient, you should destroy this immediately. Any dissemination, copying or circulation of this communication in any form is strictly prohibited. This material should not be circulated in countries where restrictions exist on soliciting business from potential clients residing in such countries. Recipients of this material should inform themselves about and observe any such restrictions. Recipients shall be solely liable for any liability incurred by them in this regard and will indemnify Ambit for any liability it may incur in this respect. Neither Ambit nor any of their respective affiliates or representatives make any express or implied representation or warranty as to the adequacy or accuracy of the statistical data or factual statement concerning India or its economy or make any representation as to the accuracy, completeness, reasonableness or sufficiency of any of the information contained in the presentation / newsletter / report herein, or in the case of projections, as to their attainability or the accuracy or completeness of the assumptions from which they are derived, and it is expected each prospective investor will pursue its own independent due diligence. In preparing this presentation / newsletter / report, Ambit has relied upon and assumed, without independent verification, the accuracy and completeness of information available from public sources. Accordingly, neither Ambit nor any of its affiliates, shareholders, directors, employees, agents or advisors shall be liable for any loss or damage (direct or indirect) suffered as a result of reliance upon any statements contained in, or any omission from this presentation / newsletter / report and any such liability is expressly disclaimed. Further, the information contained in this presentation / newsletter / report has not been verified by SEBI. You are expected to take into consideration all the risk factors including financial conditions, risk-return profile, tax consequences, etc. You understand that the past performance or name of the portfolio or any similar product do not in any manner indicate surety of performance of such product or portfolio in future. You further understand that all such products are subject to various market risks, settlement risks, economical risks, political risks, business risks, and financial risks etc. and there is no assurance or guarantee that the objectives of any of the strategies of such product or portfolio will be achieved. You are expected to thoroughly go through the terms of the Private Placement Memorandum (PPM) / agreements and understand in detail the risk-return profile of any security or product of Ambit or any other service provider before making any investment. You should also take professional / legal /tax advice before making any decision of investing or disinvesting. The investment relating to any products of Ambit may not be suited to all categories of investors. Ambit or Ambit associates may have financial or other business interests that may adversely affect the objectivity of the views contained in this presentation / newsletter / report. Ambit does not guarantee the future performance or any level of performance relating to any products of Ambit or any other third party service provider. Ambit shall not be liable for any losses that you may suffer on account of any investment or disinvestment decision based on the communication or information or recommendation received from Ambit on any product. Further Ambit shall not be liable for any loss which may have arisen by wrong or misleading instructions given by you whether orally or in writing. The name of the product does not in any manner indicate their prospects or return. This presentation is qualified in its entirety by the Information Memorandum/PPM/Term Sheet/Contribution Agreement and other related documents, copies of which will be provided to prospective investors. All investors must read the detailed PPM including the Risk Factors and consult their tax advisors, before making any investment decision/contribution to AIF. Capitalized terms used herein shall have the meaning assigned to such terms in the PPM and other documents. Strictly confidential for private circulation only, not for public distribution. You may contact your Relationship Manager for any queries